Whole Life vs. Term Life Insurance: Why Whole Life Insurance Is the Smarter Choice for Building Wealth and Security

When it comes to protecting your family’s financial future, choosing the right life insurance policy is one of the most important decisions you’ll ever make. Two of the most common options are whole life insurance and term life insurance—but they couldn’t be more different in what they offer.

At first glance, term life insurance seems like the “cheaper” option, while whole life insurance appears to have a higher upfront cost. But what most people don’t realize is that whole life insurance is an asset—not just an expense.

In this article, we’ll break down the key differences between whole life vs. term life, why whole life insurance is the superior choice for long-term financial security, and how it can help you build wealth, create financial certainty, and leave a lasting legacy.

What Is Whole Life Insurance?

Term life insurance is temporary coverage that lasts for a specific period, usually 10, 20, or 30 years. If you pass away within the term, your beneficiaries receive a death benefit payout. But if you outlive the policy, the coverage expires, and you get nothing back.

Pros of Term Life Insurance:

✔️ Lower initial premiums

✔️ Provides a temporary safety net for families

✔️ Simple and easy to understand

Cons of Term Life Insurance:

❌ No cash value – It doesn’t build wealth or savings.

❌ Coverage expires – If you outlive the term, your family gets nothing.

❌ Becomes expensive later – Renewing or buying new coverage as you age gets prohibitively expensive.

❌ No living benefits – You only benefit if you die within the term.

Many people compare term life insurance to renting—you pay for coverage, but you don’t build any value. It’s a temporary solution, not a long-term financial strategy.

What Is Term Life Insurance?

Whole life insurance is a permanent policy that provides lifelong coverage while also building cash value—a tax-advantaged savings component that grows over time.

This means you’re not just paying for insurance—you’re building wealth in a policy that provides guaranteed financial security.

Pros of Whole Life Insurance:

✔️ Lifelong Coverage – Never expires as long as premiums are paid.

✔️ Guaranteed Cash Value Growth – Acts as a savings vehicle, growing tax-deferred.

✔️ Dividend Payments – Many whole life policies pay annual dividends, further boosting your wealth.

✔️ Tax-Free Loans & Withdrawals – Borrow against your policy with no credit checks or tax penalties.

✔️ Estate Planning Benefits – The death benefit passes to your family income-tax-free.

✔️ Acts as a Personal Banking System – You can use your policy to fund investments, businesses, or emergencies.

Cons of Whole Life Insurance:

❌ Higher initial premiums compared to term (but it’s because you’re building wealth, not just buying insurance)

Whole life insurance is like owning a home—your payments go toward building equity, giving you an asset that provides financial benefits for a lifetime

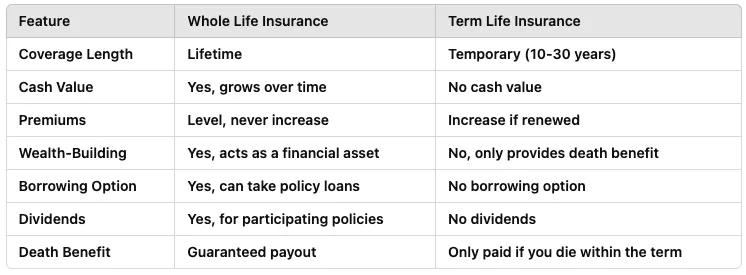

Key Differences: Whole Life vs. Term Life Insurance

Why Whole Life Insurance Is the Smarter Choice

Many financial “gurus” push the idea of “buy term and invest the rest.” While that sounds good in theory, the reality is that:

1️⃣ Most people don’t actually invest the difference. Life gets in the way, and money often goes toward expenses rather than disciplined investing.

2️⃣ Term insurance becomes too expensive later in life. If you develop health issues or outlive your policy, buying a new one in your 50s or 60s becomes nearly impossible or unaffordable.

3️⃣ Whole life is a guaranteed financial asset. Unlike the stock market, which is unpredictable, whole life insurance offers steady, compounding growth, tax advantages, and guaranteed protection.

Think About This:

👉 100% of term policies expire before paying out a benefit. That means people pay premiums for decades but receive nothing in return.

👉 Whole life insurance guarantees a payout. Whether at 40, 60, or 90, your family will receive a tax-free benefit no matter what.

👉 With whole life insurance, you don’t just pay for coverage—you build wealth.

How Whole Life Insurance Helps You Build Wealth

One of the most powerful benefits of whole life insurance is its cash value component, which acts like a high-interest savings account inside your policy.

This cash value:

✅ Grows tax-deferred, compounding over time.

✅ Can be borrowed against, allowing you to use it for investments, real estate, emergencies, or retirement.

✅ Pays dividends, further increasing your wealth.

✅ Provides a financial safety net, so you don’t have to rely on banks for loans.

This gives you complete control over your finances, allowing you to access capital whenever you need it.

Who Should Consider Whole Life Insurance?

Whole life insurance is ideal for:

✔️ Parents & Families – Provides lifelong protection and financial security.

✔️ High-Income Earners – Offers tax-advantaged savings and estate planning benefits.

✔️ Business Owners – Can be used as collateral for loans or cash flow management.

✔️ Investors & Entrepreneurs – Acts as a personal banking system to fund new ventures.

✔️ Retirees & Pre-Retirees – Creates a tax-free income stream in retirement.

If you want a financial asset that provides security, stability, and long-term wealth, whole life insurance is the best choice.

Final Thoughts: The Winner? Whole Life Insurance

When comparing whole life vs. term life insurance, the choice is clear:

🔹 Term life insurance is temporary protection—it’s like renting a policy with no lasting value.

🔹 Whole life insurance is a lifelong financial asset—it provides guaranteed coverage, builds wealth, and creates financial freedom.

While term life insurance may seem cheaper in the short term, whole life insurance provides lasting value, financial security, and a wealth-building strategy that benefits both you and your family for generations.

💡 Want to learn more? Click the Button Below to Watch our Free On-Demand Masterclass and let’s explore how whole life insurance can help you secure your financial future.

About Us

© Copyright 2025 Whole Life Insurance Information

16373500 Canada Association - All rights reserved.

The platform is a project of a foundation for public benefit.

Our Mission

We empower families with the knowledge and tools to take control of their financial futures through whole life insurance. By providing expert guidance, we ensure lasting security, peace of mind, and the confidence to thrive no matter what life brings.

Copyrights 2025 | Whole Life Insurance Information | Contact Us | FAQ

Copyrights 2024 | Whole Life Insurance Information