What Is Whole Life Insurance? The Ultimate Guide to Building Wealth and Financial Security

When it comes to securing your family's financial future, life insurance is one of the most important financial tools you can have. But not all life insurance policies are created equal.

While many people are familiar with term life insurance, whole life insurance offers a powerful combination of lifelong coverage, wealth-building opportunities, and financial security that term insurance simply can’t match.

If you’ve ever wondered “What is whole life insurance?”, you’re in the right place. In this article, we’ll break down:

✅ What whole life insurance is

✅ How it works

✅ The benefits of whole life insurance

✅ Why it’s a powerful financial tool for building wealth

✅ Who should consider it and how to get started

By the end, you’ll see why whole life insurance isn’t just life insurance—it’s a financial asset that can help you create generational wealth.

What Is Whole Life Insurance?

Whole life insurance is a type of permanent life insurance that provides lifelong coverage and includes a built-in savings component known as cash value. Unlike term life insurance, which only lasts for a specific number of years, whole life insurance is designed to last your entire life—as long as premiums are paid.

Key Features of Whole Life Insurance

✔️ Lifelong Protection – Never expires, no matter how long you live.

✔️ Fixed Premiums – Your payments never increase, even as you age.

✔️ Cash Value Growth – A portion of your premium builds tax-advantaged savings.

✔️ Dividends – Many whole life policies pay annual dividends, increasing your wealth.

✔️ Tax-Free Death Benefit – Your family receives a guaranteed, tax-free payout.

Whole life insurance is much more than just a safety net for your loved ones—it’s a financial tool that helps you build, protect, and access wealth throughout your lifetime.

How Does Whole Life Insurance Work?

Whole life insurance is structured to provide both financial security and savings growth over time. Here’s how it works:

1️⃣ Your Premiums Are Split Into Two Parts

When you pay your whole life insurance premium, the money is allocated in two ways:

🔹A portion goes toward the life insurance coverage (to ensure your death benefit).

🔹The rest goes into your policy’s cash value, where it grows over time.

2️⃣ Your Cash Value Grows Tax-Free

Unlike a savings account or taxable investments, the cash value inside your policy grows tax-deferred. This means your money can compound faster since you’re not paying taxes on it every year.

3️⃣ You Can Borrow Against Your Cash Value

One of the biggest advantages of whole life insurance is that you can borrow against your policy’s cash value—without going through a bank, without credit checks, and without tax penalties.

This makes whole life insurance a powerful tool for personal banking, allowing you to:

✔️ Fund major purchases

✔️ Invest in real estate

✔️ Start or expand a business

✔️ Cover emergency expenses

✔️ Supplement your retirement income

4️⃣ You Receive a Guaranteed Death Benefit

No matter how long you live, your family will receive a 100% tax-free payout when you pass away. This provides peace of mind, knowing your loved ones will be financially secure.

5 Major Benefits of Whole Life Insurance

1. Guaranteed Lifetime Coverage

Unlike term life insurance, which expires after a set period, whole life insurance lasts your entire life. You’ll never have to worry about your coverage running out when you need it most.

2. Cash Value Growth – A Built-In Wealth-Building Tool

Whole life insurance isn’t just about protection—it’s also a safe, tax-advantaged savings vehicle.

💡Think of it like a high-interest savings account that also provides life insurance protection.

The cash value in your policy grows steadily and predictably over time, making it a low-risk asset that can be used for:

✅ Emergency funds

✅ College tuition for your kids

✅ Business funding

✅ Retirement income

Unlike stocks or real estate, your cash value is not affected by market downturns, providing consistent, reliable growth.

3. Tax-Free Benefits

One of the biggest advantages of whole life insurance is its tax benefits:

✔️ Tax-Free Death Benefit – Your beneficiaries receive their payout without paying income tax.

✔️ Tax-Deferred Cash Value Growth – Your money compounds without being taxed each year.

✔️ Tax-Free Loans – You can borrow against your policy without triggering taxable income.

This makes whole life insurance one of the most tax-efficient ways to grow and transfer wealth.

4. Dividends – Extra Money in Your Pocket

Many whole life insurance policies (from mutual insurance companies) pay annual dividends. These dividends can be:

🔹 Reinvested to grow your cash value faster

🔹 Used to pay premiums

🔹 Taken as cash

While dividends aren’t guaranteed, many insurers have a strong track record of paying them consistently.

5. It Acts as Your Own Private Bank

Because you can borrow against your policy’s cash value, whole life insurance allows you to become your own banker.

✔️ Need capital for a business? Borrow from your policy.

✔️ Want to invest in real estate? Use your policy’s cash value.

✔️ Have an unexpected expense? Access your funds without penalties.

This strategy—known as Infinite Banking—is used by wealthy families, business owners, and investors to build, use, and pass down generational wealth.

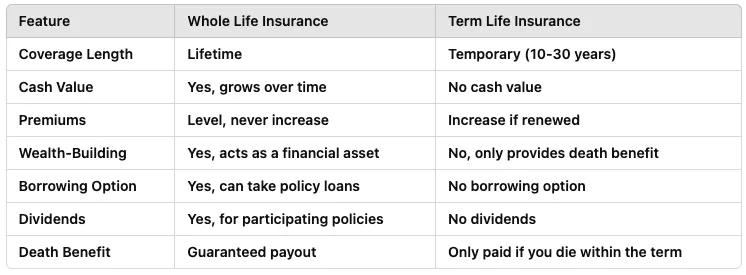

Whole Life Insurance vs. Term Life Insurance

Term life insurance is like renting a policy—you pay for protection but build no equity.

Whole life insurance is like owning a financial asset that provides security, savings, and legacy wealth.

Who Should Consider Whole Life Insurance?

Whole life insurance is ideal for:

✔️ Parents & Families – Ensures lifelong protection and creates generational wealth.

✔️ High-Income Earners – Offers tax-advantaged savings and estate planning benefits.

✔️ Business Owners & Entrepreneurs – Provides liquidity and funding options.

✔️ Investors – Acts as a low-risk, tax-free wealth-building tool.

✔️ Retirees & Pre-Retirees – Offers a tax-free retirement income stream.

Final Thoughts: Is Whole Life Insurance Right for You?

Whole life insurance is much more than just a life insurance policy—it’s a wealth-building asset that provides:

✔️ Lifelong protection

✔️ Guaranteed cash value growth

✔️ Tax-free wealth accumulation

✔️ Financial security for generations

If you want to take control of your financial future and build lasting wealth, whole life insurance is one of the best investments you can make.

💡 Want to learn more? Click the Button Below to Watch our Free On-Demand Masterclass and discover how whole life insurance can help you achieve financial freedom for you and your family. 🚀

About Us

© Copyright 2025 Whole Life Insurance Information

16373500 Canada Association - All rights reserved.

The platform is a project of a foundation for public benefit.

Our Mission

We empower families with the knowledge and tools to take control of their financial futures through whole life insurance. By providing expert guidance, we ensure lasting security, peace of mind, and the confidence to thrive no matter what life brings.

Copyrights 2025 | Whole Life Insurance Information | Contact Us | FAQ

Copyrights 2024 | Whole Life Insurance Information